Understanding Your Payslip: A Comprehensive Guide for Filipino Employees

Understanding your payslip is crucial for every Filipino employee. Welcome to our comprehensive guide that will help you decode the various components of your payslip, including deductions, allowances, and net pay. We’ll also show you how an HRIS system simplifies this understanding, making managing your finances easier than ever.

The Components of a Payslip

Understanding your payslip can greatly enhance your financial management. Let’s break down the key components you’ll find on a typical Filipino payslip:

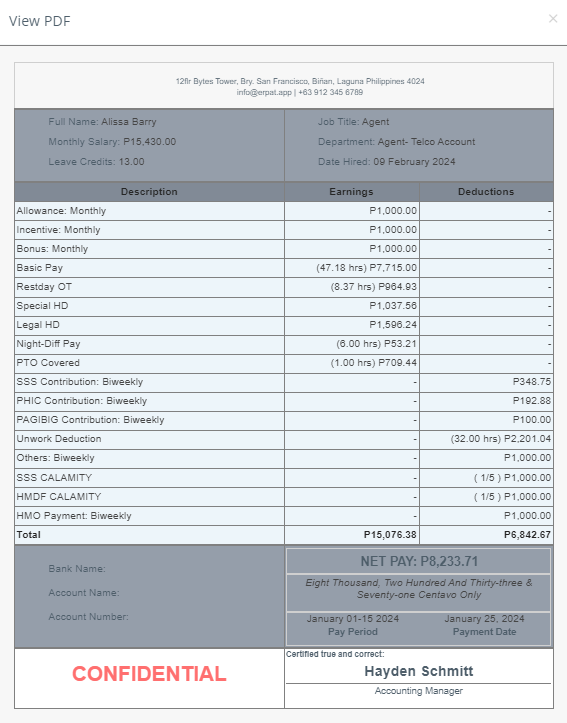

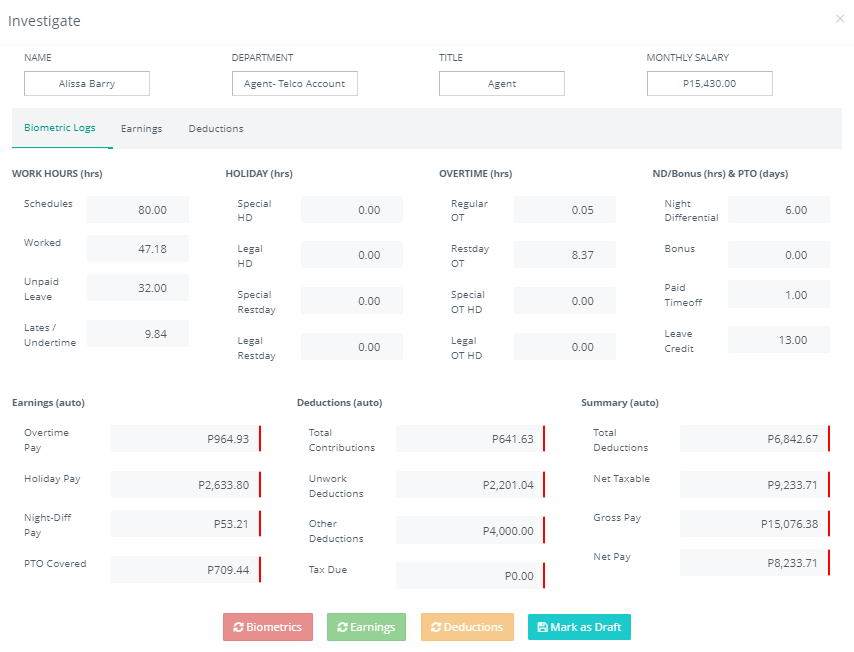

1. Basic Salary:

Your basic salary is the foundation of your earnings, calculated based on your agreed-upon rate and the number of days or hours you’ve worked.

2.Allowances:

Allowances are additional payments on top of your basic salary. Common allowances include:

Covers commuting expenses.

Reimburses daily meal costs.

Assists with housing expenses.

3. Overtime Pay:

Overtime pay is compensation for hours worked beyond your regular schedule, usually at a higher rate.

Additional pay for hours worked beyond the standard work schedule.

Extra compensation for hours worked on designated rest days.

4. Holiday Pay:

Compensation for working during holidays:

Higher pay for working on special non-working holidays.

Premium pay for working on regular holidays.

5. Night Differential:

Additional pay for working night shifts, typically between 10 PM and 6 AM, to compensate for the inconvenience of working late hours.

6. Paid Time Off (PTO):

This includes paid leave days you are entitled to, such as vacation leave, sick leave, and personal leave. PTO ensures you receive your salary even when taking authorized time off.

7. Bonuses:

Bonuses are extra payments for performance or as part of your employment contract. These can include:

A mandatory bonus in the Philippines, equal to one-twelfth of your annual salary.

Rewards based on your job performance.

8. Statutory:

A mandatory withholdings that employers must deduct from an employee’s gross pay. These deductions are required by law and are intended to fund various government programs and services.

Income tax based on your earnings.

Mandatory contributions to the Social Security System.

Contributions to the Home Development Mutual Fund.

Health insurance coverage deductions.

9. Loans

Deductions for repaying various loans:

Loans provided by your employer.

Emergency loans from Pag-IBIG for disaster-related purposes.

Loans from Pag-IBIG for personal financial needs.

Loans from the Social Security System for short-term financial needs.

Emergency loans from SSS for members affected by calamities.

The total earnings before any deductions. It includes your basic salary, overtime pay, allowances, holiday pay, and any other additional earnings.

10. Gross Pay:

The total earnings before any deductions. It includes your basic salary, overtime pay, allowances, holiday pay, and any other additional earnings.

11. Net Taxable Income:

The portion of your gross pay that is subject to tax after allowable deductions, such as SSS, PhilHealth, and Pag-IBIG contributions.

12. Net Pay:

Your net pay is your take-home amount after all deductions, the actual amount deposited into your bank account.

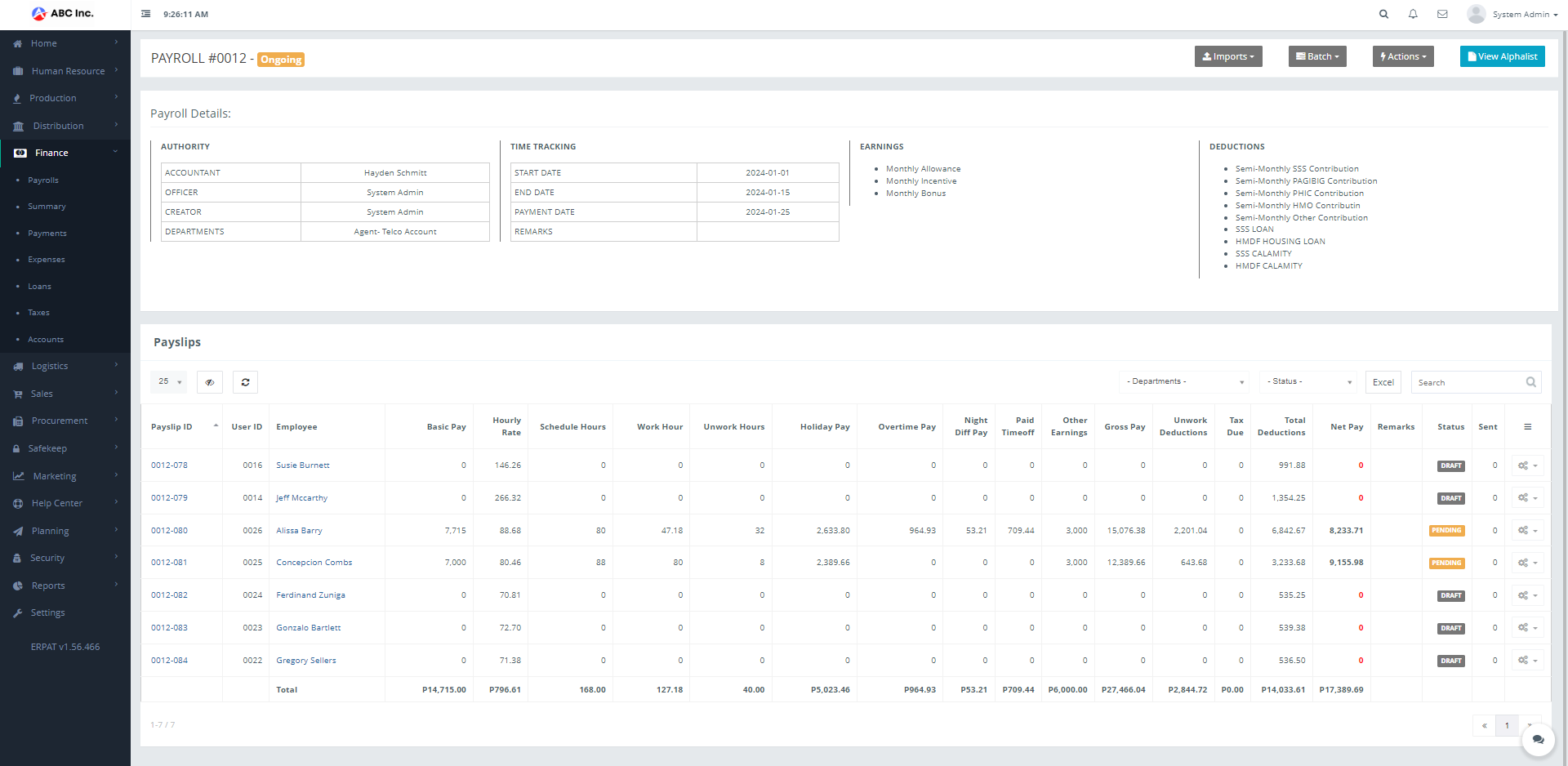

ERPat: Syntry Payroll Sample

How HRIS Simplifies Payslip Understanding

An HRIS (Human Resource Information System) can greatly simplify understanding your payslip. Here’s how:

-

1. Clear Breakdown of Earnings and Deductions: An HRIS provides a detailed breakdown of your earnings and deductions, making it easier to see how your net pay is calculated.

-

2. Easy Access to Historical Payslips: HRIS allows you to access and review past payslips easily, helping you track changes over time.

-

3. Real-Time Updates: With HRIS, any changes in salary, tax rates, or contributions are automatically updated, ensuring your payslip is always accurate.

-

4. Personalized Insights: HRIS systems often include tools that show how different factors, such as overtime or allowances, impact your net pay, helping you make informed financial decisions.

Understanding your payslip is essential for effective financial management. By knowing the various components—such as deductions, allowances, and net pay—you can gain better control over your earnings. An HRIS system simplifies this process by providing clear breakdowns, easy access to historical data, real-time updates, and personalized insights. Discover the power of HRIS to make sense of your payslip and take charge of your financial well-being.

Ready to Decode Your Payslip Like a Pro?

Transform your payroll experience with the latest HRIS technology. Say goodbye to confusion and hello to clarity, accuracy, and peace of mind. Join the revolution and empower yourself with our cutting-edge HRIS solution today! Let’s stay Connected!

Follow us on social media for the latest updates, tips, and more on how HRIS can transform your work life.

No Comments